Electric Vehicle Incentives

EV Incentives

With recent federal legislation, the electric vehicle incentives are changing. The good news is that the changes are helping to spur the transition to clean transportation. Depending upon where you live and your household income, EV incentives may include federal tax credits for EVs and home charging, a state rebate, and rebates from your utility or local electricity provider.

Have Questions?

Join EV experts for a webinar to learn how to save money right now when you switch to an EV, and in the meantime, learn about incentives below.

Clean Vehicle Credit (Federal Tax Credit)

In accordance with proposed IRS regulations, beginning January 1, 2024, Clean Vehicle Tax Credits may be initiated and approved at the point of sale. Stay up to date on which EVs qualify.

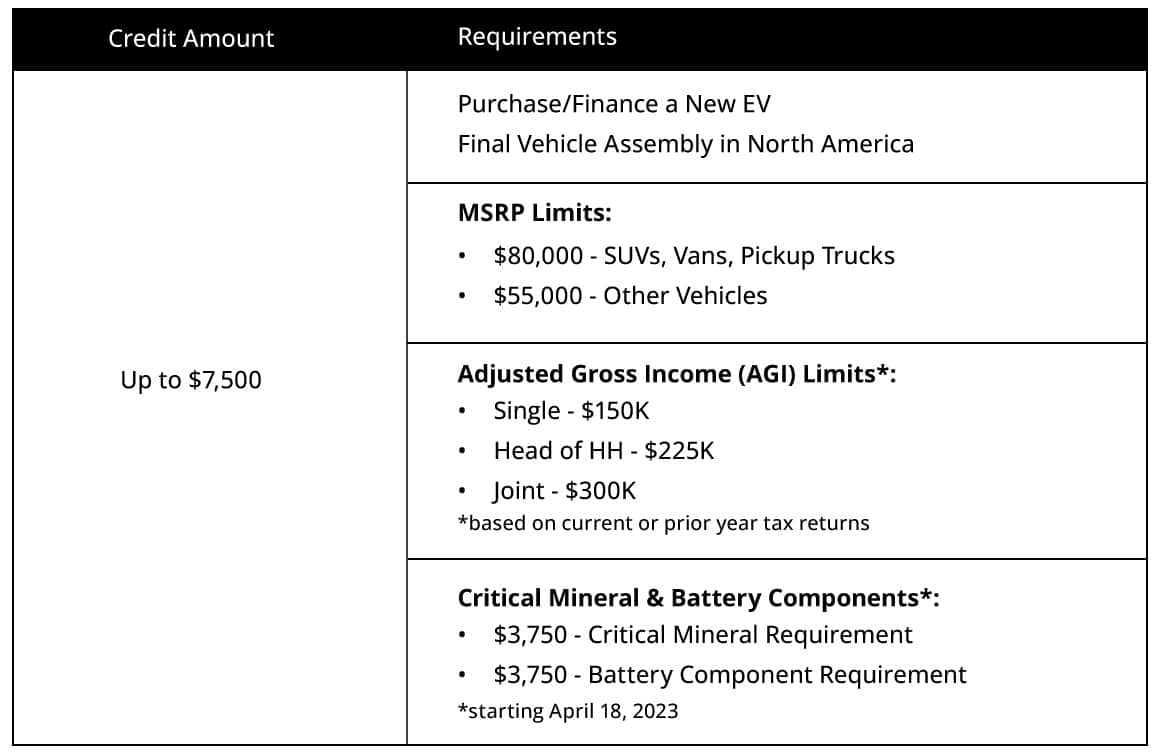

Purchase/Finance a New EV

Right now, qualified buyers may receive the full $7,500 federal tax credit on select EV models. Effective January 1, 2024, the IRS will add new requirements which may result in reduced tax credits on some vehicles and some vehicles may no longer qualify.

Lease a New EV

Purchase/Finance a Previously Owned EV

If you buy a qualified used EV from a licensed dealer for $25,000 or less, you may be eligible for the Used Clean Vehicle Credit.

The credit equals 30% percent of the sale price up to a maximum credit of $4,000. The credit is claimed against your tax liability the year you take delivery.

Other Incentives

State Rebates

Utility/CCA Incentives

Some utilities and alternative electricity providers (CCAs) offer additional rebates.

Vehicle Retirement

You may qualify for a rebate of $1,000 to retire an older vehicle. Learn about the program.

Savings Calculator

Find out what incentives you qualify for with this EV savings calculator.

Home EV Charging Tax Credit

If you purchase an EV charger for your home, you may be eligible to receive a 30% tax credit up to $1,000. The tax credit covers both hardware and installation costs.

Claim your tax credit with this tax form and instructions.